With sales figures that compare with the whole US market, the company quickly claimed the title of leader in its market.

What makes the brand so successful in a market where customers have trouble making the difference between all the offers available?

Rad Power who?

Often, when I mention Rad Power, I get big, interrogative, looks. Truth is the brand name often rings no bell, even amongst the E-Bike aficionados, and especially in Europe.

Thing is, they own the title of the most funded E-Bike company in the world, with a total $329 million in investments since it was created, and a last round of $154 million. The second most funded company is a Dutch one, VanMoof, with $189 million received as investment overall.

But those two companies could not be more different. When VanMoof worked at making its bikes as different as possible from the competition, Rad Power did little in terms of feature, distribution, or, let’s be honest, design.

How big are they?

In October 2021, when they raised their last round, Rad Power claimed more than 350 000 customers. Note: customers, not Bikes, or, for that matter “Unique E-Bike customers”.

They also said they made more than $100M in revenue in 2019 (so even before the pandemic hit).

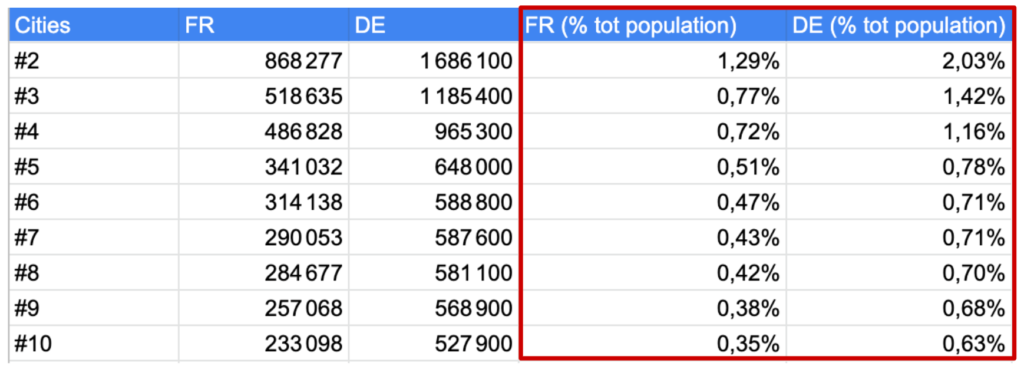

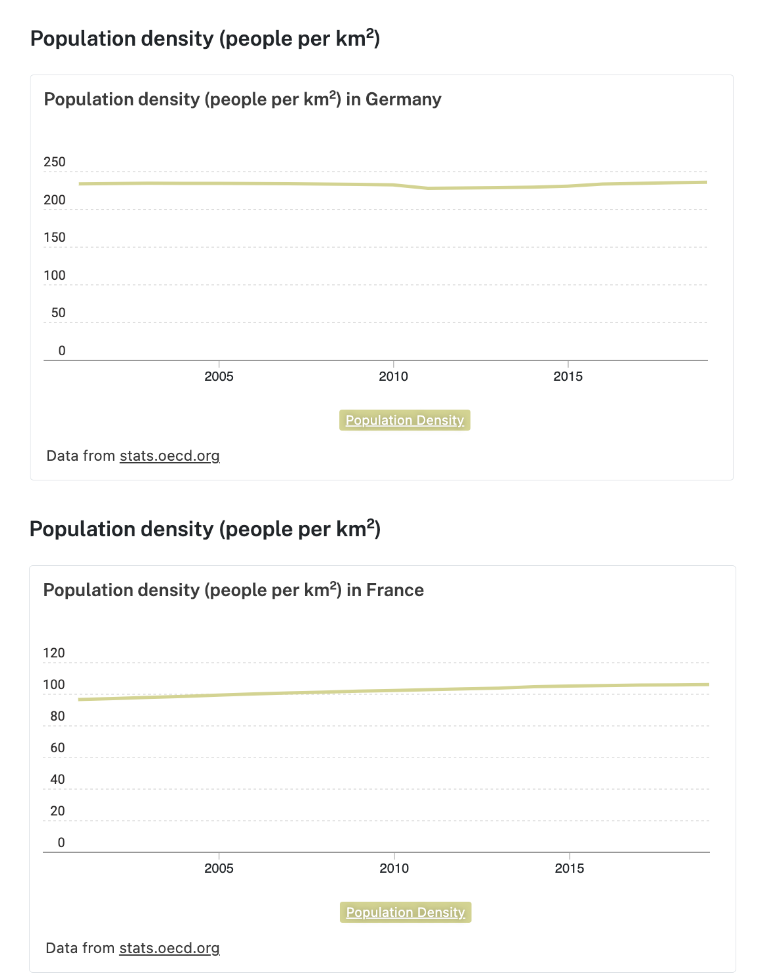

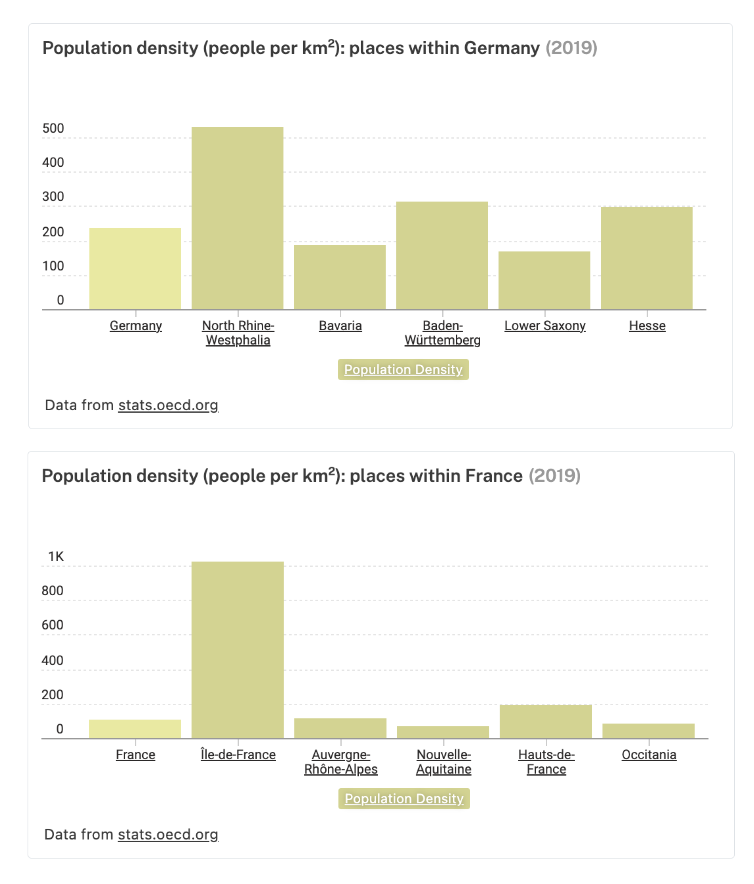

To give you a bit of perspective, the whole US market of E-Bikes in 2021 was around 790 000 bikes sold (yes, as many as Germany last year).

Of course, the Data person in me will start with a series of questions:

- Where does the data come from ?

- Is it reliable ?

- What’s the time period?

- Why do they say customers and not bikes?

- What’s the part of US sales vs Europe (or the rest of the world)?

If we only assume that their growth matched the market over the last 4 years, 2021 must have represented around 40% of their all time sales, that means around 150 000 bikes sold, or 37% of the US market in 2021.

That seems a bit much, even taking into account the possible sales they made through their B2B channel.

Nevertheless, and even taking those numbers carefully, they are one of the major E-bikes manufacturers in the US, and certainly the biggest “e-pure-player” (by opposition to big groups like Giant or Pon who also offer non E-bikes).

They also have a staff of more than 700 people, comprable with VanMoof’s 600 people staff.

How are they different?

They’re not, really.

Indeed, the bikes, made mostly in China and Taïwan (but very likely only for the top of the range) and mostly distributed online, seem to offer very little differentiation compared to, again, their European counterpart, VanMoof.

But the bikes have one major advantage: they just work.

The brand seems to have put all its energy providing a reliable, inexpensive, non disruptive experience.

They offer 11 bikes, from a bit less than 1000€ to just under 2000€ for their “All-Road” model.

They even offer a cargo bike (more exactly a long-tail bike) for 1899€.

So it’s all about the value for money?

Well, yes and no.

If we take their cheapest bike, the RadMission, There are a lot of bikes out there very comparable:

- Aluminium frame made in China

- Single gear

- Mechanical brakes

- Kenda tires

- Non-differentiating design and geometry

To us, those bikes are different only for 3 reasons

- A high-quality 504Wh battery (when most competitors, at that price point, offer a 418Wh battery, best case scenario)

- A cadence sensor

- Dozens of accessories to customize your bike without the struggle of finding the rack that will work “with that version of the stem on that generation of bike…”

And also the brake lights, also known as the Boomers’ special feature.

Bottom line is: they’re good enough, and the “big” battery is a real plus to make the experience good for customers, and create a positive word of mouth.

But what seems to make the brand very different, is somewhere else: it’s the way they tackle problems to make things happen for their customers, no matter what. 2 examples:

- They chartered their own carriers to make sure parts would arrive on time to make the bikes.

- They started a mobile maintenance and repair service, that also offered to deliver your bike mounted directly at your door (great way to bridge the digital gap and make sure people actually ride your bikes).

Can they make more premium bikes?

That seems to be a good plan.

Here is why:

- The new funding round will have an impact on how they manage their performance ratios, and it’s always better to sell one 3000€ bike than three 1000€ bikes.

- The hard part is to make people start riding bikes. When that’s done, the price barrier tends to go further up (see the average price of bikes sold in Germany or the Netherland).

- They’ve already increased their prices in December, right after the funding happened. It may have been part of the deal.

- They plan to enter the European market, already much more mature than the US.

And here is how:

- They’re going to open 5 stores in 2022 (Vs 5 as of April 2022). And they will discontinue the mobile service at the same time.

- Focus the production with high quality partner (maybe produce more in Taïwan than in China)

- Their top range (~2000€ bikes) is not MUCH cheaper than the competition, but at that price you can get a Long Tail bike or a pretty versatile off-road bike. They can use the experience on that segment to build, for example, a real cargo bike, with a lot of customization.

- It’s in their DNA: offer even more options that add-up in terms of $: more services, features, options, accessories…

Europeans might not realize it at first, but we’re definitely going to see more Rad Power Bikes in the streets very soon.